|

Have you noticed any changes in your personal insurance premiums lately? If not, consider yourself fortunate amidst the evolving landscape of the insurance industry. While recent years have seen challenges such as increased claims and underwriting losses, it's also a period of transformation and adaptation.

In 2023, AM Best downgraded 39 personal lines carriers and issued a negative outlook for the segment, prompting many companies to reassess their strategies. This has led to adjustments in rates, reflecting a commitment to stability and sustainability across the spectrum. Understanding the dynamics behind insurance premiums sheds light on the current situation. A company's combined ratio, which factors in expenses and claims relative to premiums, is a key metric. Ideally, a ratio below 100 signifies a healthy market, where premiums exceed losses and administrative costs. However, recent trends have seen ratios surpassing this threshold. For instance, State Farm, a prominent player, faced challenges with combined ratios of 129.5 in 2022 and 117.3 in 2023, alongside a credit rating adjustment. Several factors contribute to this trend, including severe weather events, inflation impacting property replacement costs, and discrepancies in property valuation, termed 'Insurance to value.' (A previous Slice article titled The Three I’s can be referenced on our site at hsrisksolutions.com.) Despite these challenges, the industry is resilient, continually innovating to mitigate risks and enhance customer experiences. Efforts to manage risk extend beyond insurers to policyholders themselves. Ensuring adequate coverage and understanding settlement clauses are crucial steps. Moreover, property maintenance and proactive risk mitigation play significant roles. Technological advancements, such as drone inspections for property assessment, illustrate the industry's commitment to leveraging innovation for better outcomes. Navigating these changes necessitates informed decisions and trusted guidance. Working with a Trusted Risk Advisor can provide invaluable insights into coverage options and risk management strategies. Remember, insurance is more than just a financial product — it's a safeguard for your assets and peace of mind. While challenges persist, the insurance industry is resilient and adaptive. As stakeholders collectively weather this storm, expect to see continued evolution and innovation, ultimately ensuring a robust and sustainable future for personal lines insurance. Your involvement and awareness contribute to shaping this transformative journey, where every policyholder plays a vital role in shaping the future of the industry. And remember, “Who insures you doesn’t matter…until it does.”

0 Comments

When’s the last time that your premiums for healthcare went down? A rhetorical question, of course. With lightning-speed advances in technologies, it’s a wonder that healthcare isn’t as efficient as the other goods and services we rely on each day.

While it would take a book to clearly explain all the variables creating such a challenge for the healthcare space, following are a few trends contributing to the challenge. First, most hospitals and their affiliated providers do not know what procedures cost on a “Activity based” cost accounting method. They focus on labor (time) in a fragmented manner. Additionally, Medicare and Medicaid patients are cross subsidized with commercial plans. As articulated in a previous Slice, Commercial plans paid 248% of what Medicare paid for claims in 2020. If everyone was covered under such a subsidized plan, hospitals would go bankrupt and physicians’ financial debt would never get paid off, not to mention that the talent pool entering the healthcare industry and quality of care would suffer. Let’s not forget that with healthcare, we are dealing with a variable that is very hard to control, humans and their habits. Many people drive their body to the brink for many years in hopes that the healthcare system will save them when all else fails. Thus, we’ve become a system of treating illness (Sick Care) as opposed to supporting health and healthy habits (Well Care). And, as one who enjoys taking it to the brink occasionally, I’m not sure that’s going to change drastically for the masses, despite our propensity to want to be healthy. Since the end of the COVID-19 Pandemic, outpatient procedures have increased. Surgeries performed in a hospital setting are more expensive than those performed at a doctor’s office or freestanding surgical center. Also, many physicians are now affiliated with a larger hospital group or health care entity and thus, charging more for services. Additionally, more people are seeking out behavioral healthcare, and the Mental Health Parity laws have put such appropriate services on par with covered medical procedures. All of this is exasperated by a shortage of skilled experts to provide services, such as nurses and doctors. But, perhaps most of all, the demand for certain pharmaceutical brands tops the list. Following is a list of the top 10 selling drugs and the associated dollars spent by Medicare Part D in 2021 (source: Kaiser Family Foundation Analysis): Drug Brand $ in Billions

While the inefficiencies and expensive treatments are evident, the free market is certainly responding with solutions. Generic forms of the diabetes and weight loss drugs (technically called Semaglutide or GLP-1s) are being developed for a much lower price. Coincidentally, the government is attempting to control pricing for a select list of expensive and commonly used drugs within the Medicare system. Although the pharmaceutical lobbying group (PhRMA) is suing the current administration on the grounds that the proposed negotiated pricing model violates several constitutional amendments and the separation-of-power principle, the administration is forging ahead on behalf of Medicare beneficiaries (Mostly people aged 65+). The drug manufacturers claim that forced price negotiations, as opposed to market based pricing, would significantly curtail profits, and force them to pull back on developing new treatments. Stay tuned to the airwaves for updates on that front. Healthcare is certainly a complex web and involves skilled people, technologies, and business acumen. Therefore, while efforts will continue to persist in creating less expensive alternatives, don’t expect your cost of healthcare to go down anytime soon. Perhaps the best way to save is to create and sustain healthy habits. If you own property, then you likely have property insurance coverage. Lately, you’ve probably noticed an increase in your premiums, even though you have not experienced a loss in a long time. You can place most of the blame on the Three I’s, which I will explain as you read on. While this is aggravating to all of us, if we return to the fundamentals of insurance, it starts to make sense.

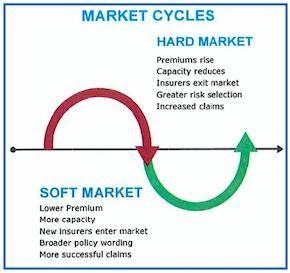

Insurance centers around the law of large numbers. You get enough people to pay a reasonable premium to cover the probable losses, computed by actuarial analysis, and you have the resources to pay claims as losses occur. For catastrophic losses, insurance carriers enter into reinsurance agreements, whereby the reinsurer assumes the liability for paying losses more than the insurer’s limit. For example, let’s assume that company X insures many people in the path of a hurricane with aggregate losses in the tens of millions. Company X likely has an agreement with a reinsurer to cover losses more than a certain amount. So, in this hypothetical case, Company X will pay up to the aggregate loss amount indicated in the agreement and the reinsurer will pay the excess amount. This type of arrangement has provided stability in the property market for many years as the reinsurers pay a bulk of catastrophic losses, which until recently, have been far more predictable. Currently, we are experiencing what’s called a “Hard” market for property. That means premiums are higher and, in some instances, coverage limits are reduced. This is especially prevalent in the commercial markets. In the personal lines markets, carriers are either significantly raising premiums, reducing coverage or non-renewing policies in areas prone to losses. So, you might ask why, especially with the backstop of re-insurance? Read on for the ugly truth. During 2022, the US experienced approximately 22-Billion-Dollar + weather and climate disasters. With hurricane Ian topping the list at approximately $112 Billion, none of the events were small. Concurrently, inflation has shown its ugly face causing properties to be undervalued on many insurance policies (Insured to value is the term used to assess whether the replacement cost of the property is appropriately valued). We can summarize these realities as the Three I’s. Remember, when an insurance company must replace a property, they don’t have the luxury of time to plan the project like a developer. They must replace the property promptly and with the same materials, quality, and workmanship to put you back to the place that you were prior to the loss. Therefore, they are paying top dollars in many cases to restore the property. That’s why sometimes, replacement cost estimates can be higher than market value. So, analyzing the effect of the Three I’s; Ian (and other superstorms), Inflation, and Insured to value, let’s also look at human nature. Most successful people like to matriculate to places that are exciting or pleasant like; Florida and other coastal communities (Hurricanes), California (Wildfires and Earthquakes), and the mountains (Wildfires). Successful people like to move to nice places that keep them close to their friends, creating an abundance of property value in those areas. When a catastrophic event hits, it doesn’t discriminate. And, with all that value at risk, even the reinsurance companies can lose billions replacing and repairing damaged property. The same fundamentals apply to commercial risks, as population dictates the needs for goods and services to be delivered in those areas. So, for the first time in many years, we are experiencing the perfect storm in the property markets. Capacity is decreasing, as many reinsurers are unwilling (or unable) to strike the same deals that they have in past years, while premiums for those that are willing to play are skyrocketing, and often for less coverage. That’s how the Three I’s have delivered our “Hard “market. Until the conditions change (Inflation) and mother nature decides to settle down a bit, we are navigating a very difficult property market and, even if you live in an area less prone to catastrophic events, you are still part of the “Large number” and will feel the pain. Remember when you were sick as a child — where did you go for care? You probably went to your doctor’s office, which was close to your home; your appointment was easy to schedule for your parent or guardian, and you received a sucker after your diagnoses and/or treatment. While some practices still support this experience, it’s quickly becoming an obsolete model in the modern-day healthcare ecosystem. As we forge into 2023, you will notice more growth in non-traditional areas of healthcare delivery. I’ll highlight what trends we’re seeing, but first, let’s look at why changes are occurring.

While that growth continues, hospitals and traditional healthcare facilities are struggling to make ends meet for the following reasons:

In fact, most health insurance payors provide incentive for members to use less expensive services such as stand-alone imaging centers, mail order pharmaceutical centers and urgent care facilities. The emergency room is the most expensive alternative for anything other than a life-threatening event. Most cost sharing arrangements are much higher for emergency room visits than urgent care, another incentive to stay away from the hospital when appropriate. In addition, Humana is expanding its Center Well Senior Primary Care clinics. Plans project 30-50 additional centers per year through 2025, according to Humana. And while expansion in the convenience store approach continues for all ages, telehealth is becoming a popular strategy to deliver quality outcomes for those with routine symptoms and conditions such as the common cold, pink eye, etc. It really has come down to solving the accessibility and affordability issues. It’s not the first time that payors and providers have united to solve problems, however, it’s certainly more prevalent today than in past years. So, as the healthcare ecosystem continues to evolve, be aware of what’s happening in the market. It’s not like the visit to the doctor’s office of old. But whatever the evolution dictates, one thing is for sure. We will continue to need medical care and the delivery of care will continue to evolve while the private sector creates solutions to combat increasing costs. 1. Healthcare Finance

2. National Price Transparency Study by Rand. We currently live in interesting times. Whether it’s a political issue or weather events, it seems that we are constantly bombarded with significant news relating to property losses. As I’ve stated in past articles, catastrophic losses have hit record highs in the past years. Mostly due to tropical storms and wildfires, which seem to create havoc from sea to shining sea. As predicted by climatologists, the severity of our weather events will likely get worse as time moves on.

Of course, that’s why we have insurance, right? To alleviate the financial impact resulting from a peril that we can’t avoid. And thank goodness we have such protection … if we have it. What does that mean? Simply stated, all insurance coverage is not created equal. Companies create insurance policies, which are contracts, to cater to many different consumers. Although regulated by state insurance departments, they can be difficult to read and understand. There are two key parts of an insurance contract that deliver the info you need to know. The first is what’s covered (Perils Covered) and the second is the settlement clause relating to that coverage when a claim is submitted. Those two areas are the major differentiators between insurance coverage and corresponding companies. For example, assume you experience a loss which causes you to have to move out of your home temporarily. Company A’s policy might provide for additional living expenses up to a certain limit while Company B’s policy might provide a more liberal settlement such as reasonable living expenses in a habitat more closely associated with your lifestyle. It could be the difference between living in a mid- market hotel vs. living in a luxury hotel or house while you await repairs to your home to be completed. This is just one example of many that should be considered when deciding what type of company and coverage to engage with. We work with many homeowners who have coverage with companies that specialize in the affluent market. Coverage with many of the standard companies, like those advertising during the commercial breaks of your favorite football game, don’t typically have coverage parameters and settlement clauses that would suit the values and needs of those who have more to lose. In fact, the companies serving the affluent market typically have coverage parameters that are abundantly more liberal than the standard market. So, what’s the problem? Like any other product or service, it comes down to price. That’s all you hear on those commercials — how you can save more money. And that’s a logical, as we all want to spend less and save more. However, when it comes to financial decisions — of which insurance is one — pay heed to the words of the late Roberto Goizueta (Coca Cola’s previous CEO), “Don’t let price be the tiebreaker.” Simply stated, sometimes you get what you pay for. Insurance is not a consumer product that you invest in to use. In fact, you hope to never use it, thereby improving your insurance score and creating a better investing opportunity. However, accidents happen, catastrophic weather events occur, and the climate continues to dish out more turmoil. So, make sure you are covered by the right company. Talk to your Trusted Risk Advisor and don’t let price be the tiebreaker. The price doesn’t count until you have a claim. That’s when you find out the value of your policy. That’s when you know how we settle this. You’ve likely been asked to provide proof of insurance at some point in your life. Sometimes it’s

as simple as providing your health insurance card for a routine visit, or your auto insurance card for verification by law enforcement or in the case of an accident. Another form of verification used primarily for business purposes is a Certificate of Insurance (COI). This form is widely used by most businesses; however, it’s likely the most misunderstood form in the industry. A COI is a snapshot of coverage issued and provides proof of specific coverage on the date the certificate is issued. The certificate is not:

Insured” status. It’s very important to understand that the certificate does not govern coverage, rather the insurance policy (contract) is the governing mechanism. Therefore, unless the actual policy states that the requesting party is an additional insured, that status won’t be granted, even if it’s stated on the COI form. There are two ways that “Additional Insured” status can be granted. One is by specifically naming the additional insured party through a policy endorsement. Another is through a “Blanket Additional Insured” endorsement, whereby each qualifying entity can be named an additional insured if they comply with the blanket additional insured conditions. The same concept applies to those entities that request that “Waiver of Subrogation” be added to the COI. Again, the policy governs whether that clause is in effect. You might be wondering why a certificate is used since it really doesn’t apply coverage. The best answer is that a certificate, like a balance sheet, shows a snapshot of coverage on a specific date. Most times, the requesting party wants to make sure that you are covered for certain types of liability, based upon the exposure to risk. A good example is when you hire a contractor to work in your home. You certainly want to make sure that the person has insurance to cover any personal losses that he or she might experience and any losses to you while he or she is working on your property. The caveat is that you need to remember that it is the contractor’s insurance policy that governs coverage, not the COI. He or she might represent that a general liability policy exists with an aggregate limit of $1,000,000. However, if he or she has already had a claim during the year for $750,000, you now only have $250,000 worth of coverage, even though the policy and the COI indicates a limit of $1,000,000. If you really want to ensure that you know the coverage limits and you are in doubt as to the validity of what’s being represented on the COI, it’s best to ask to review the actual policy form. You can rest assured knowing that most COI forms issued are reliable reference documents and prepared by professional agents who understand the policy limits and coverage details. Just don’t mistake the COI as coverage. It’s simply a snapshot in time of what the existing policy represents. The coverage details and settlement clauses are in the policy. Have you ever had to pay an audit premium for workers compensation coverage? If so, you’d likely find it difficult to swallow the fact that over 75% of premium audits are incorrect. However, in most cases the audits are not incorrect because of the auditor, even though many auditors are not well trained on the rules. Most of those errors occur because the employers don’t keep the records that they should keep to validate the original premium amount.

Unfortunately, auditors are busy and have little interest in educating you on how to better substantiate the premium. Therefore, following some fundamental disciplines can assist you in avoiding unnecessary adjustments to your premium. Since workers compensation follows payroll records, it’s important to keep detailed records, including class code and a simple job description. Classifying employees properly and understanding those classifications is very important. If someone is classified as a clerical employee, then 100% of their duties must be clerical. If an employee has 70% clerical duties and 30% non-clerical duties, you cannot classify the employee as clerical. In a nutshell, you’re either 100% clerical or 0% clerical according to the rules. For instance, if Jane is classified as a clerical employee and periodically delivers paychecks to people on the production floor, make sure that if questioned by the auditor as to whether she ever goes to the production area, she properly answers yes, but only to deliver paychecks. If she were to answer the question as, “Yes, I go out in the production area all of the time” and doesn’t qualify the statement with the specific purpose of delivering paychecks, you could run the risk of that employee being re-classified from a clerical code to a production code, carrying a higher rate. Following are some helpful tips to keep in mind:

There are certainly other things to consider. Keeping meticulous records and making sure there is a friendly and knowledgeable person available to work with the auditor is vital. Treat the auditor as a welcomed guest. Be prepared and present a package to the auditor. Don’t go above and beyond by offering gratuitous information. Stick to the fundamental questions. And finally, don’t allow the auditor to roam around the workplace unaccompanied. It only raises the risk of someone volunteering information that might not be favorable to the audit (Remember the “Jane” example above.) If you follow the guidelines and assist the auditor in substantiating the original premium, if a grey area becomes present, the auditor will likely favor you. Most importantly, you will save time for your team and the auditor. Remember, preparedness is the key. Being prepared means keeping good records in a system that allows you to present them in an organized format. The premium audit does not have to be difficult and, depending upon how prepared you are, might even be rewarding. Recently, for more reasons than the weather, northerners have been moving down to Florida. And for those of us who have either already made the plunge or are seriously considering it, you certainly cannot come up with too many arguments against the trend. Benefits include good weather, lower taxes, better exercise alternatives in the winter months and sunshine to name a few. But there is one dark cloud hovering over the Sunshine State. That cloud is the increasing cost of homeowners insurance and, in many cases, the inability to obtain such coverage from any of the quality carriers admitted in the state.

There is a logical reason for this dilemma. For instance, during the first three quarters of 2020 alone, Florida’s domestic property insurers reported approximately one billion dollars in underwriting losses (1). Made up of many smaller Florida-based insurers, the companies have been haunted by catastrophic events and litigation over the last several years. Additionally, affluent carriers that have a national footprint and typically cover homes with replacement values above one million dollars have also experienced underwriting losses for the same reasons. While Florida does deliver a path to paradise, during the hurricane season it can sometimes deliver a storm that leaves lifelong memories. And hopefully, you are not there to experience the event! The high-priced insurance market is certainly not a reason to defer an otherwise happy and wise decision to relocate to Florida, even if only for the winter months. But there are some suggestions that would assist you in acquiring quality coverage from a carrier that will be there when you need it. Following are some suggestions when identifying a property and some insight as to some of what some of the best affluent carriers are looking for:

For those who want to live closer to the water and who want to invest in wind coverage, the requirements become much stricter.

Flood insurance is required often, depending upon the specific location. While many people don’t anticipate a loss from a flood, there are currently 4.3 million homes across the US with substantial flood risk. If all those homes were to be insured through the National Flood Insurance Program (NFIP), rates would have to increase 4.5 times to cover today’s risk, which amounts to approximately $20 billion. Due to the impact of our changing climate, new research suggests that for the 4.3 million homes with substantial flood risk today, we will see it grow to approximately $32.2 billion in 30 years (An increase of 61%) simply as a result of climate change (2). And, even though the NFIP does not cover all those properties, it has lost more than $36 billion since its inception and will undoubtedly have to go through further reforms to remain relevant for future coverage options. FEMA, which runs the NFIP, is working on new flood maps and on individual property level pricing to accurately reflect the risk resulting from the many changing conditions contributing to flood losses (3). The moral of the story is that flood rates will not get any cheaper for homes in areas where floodwaters are likely. Private insurers also provide coverage and they too will have to deal with the increased risk. While this is only a summary of some of what you’ll need to consider regarding insurance for a Florida home, it won’t deter many from making the plunge. If you are considering a move to the sunshine state, use this information to search for a home and don’t let the “Dark Cloud” hover over your house. There are many details to discuss, and we can assist, so call on us when you are ready to take the plunge. Sources: Florida Office of Insurance Regulation, FEMA Risk Rating 2.0 initiative, which will set new premiums for properties inside and outside of Special Flood Hazard Areas (SFHA), Insurance Journal March, 2021 As we continue to meander our way through the Coronavirus pandemic, life still goes on in new and interesting ways. Many people still have jobs and, for those who do not, we enthusiastically anticipate the day when those who cannot work from home are safely able to return to work. For those that are working, an altered environment at the office or home is likely the new norm. While we manage our lives through the current reality, here are some COVID-related issues looked at with a “Cause and Effect” perspective. Long Term Care Insurance

Of course, there are many other segments of the economy that have experienced drastic change and will transform practices now and in the future.. As a society, we will adapt and hopefully see a solution much sooner than in past pandemic episodes. The one constant is change, which can impact every segment of the economy in both positive and negative ways. Since we are in an election year, it is appropriate to remind you that Change has no constituency. The challenge remains, how do we manage the effects? Sources:

Insure.com assessment. Benefit Specialist Magazine. FAIR Health study, Dental Services and the Impact of COVID-19; An Analysis of Private Claims. National Underwriter 10/20 We have recently been blitzed, like the way Dick Butkus used to pursue quarterbacks when he was playing in the NFL. The pandemic in and of itself is enough to disrupt markets and create chaos; however, from an insurance perspective, the chaos was forming well before the virus appeared. “Hard markets” come and go. The last hard Market we experienced for property and casualty coverage occurred between 2001 and 2004. During that time span, property and liability rates increased by more than 55%. Currently, rates have risen for nine consecutive quarters. This is due to the influx of large catastrophic losses, accelerating claims and, most recently, uncertainty surrounding the COVID-19 pandemic. Fitch ratings projects that technical profits for major insurers won’t be seen until at least the second half of 2021. So, just what is a hard market? It occurs after insurance companies experience underwriting losses, due to abundant claims, for the time period preceding the hard market. As a result, the insurance companies raise premiums and/or reduce coverage limits that were previously offered. This results in an inflationary condition for the insured and sometimes a difficult time replacing coverage for certain types of customers. Although insurance companies maintain reserves to protect them from future losses, including catastrophic losses, the current investing environment has also contributed to the problem, as rates of return on conservative investments have been historically low causing investment returns on the reserve funds to be below historical trends. Photo credit: Outlook Q4 2019

To give you a better understanding of what to expect, here are a few examples of what’s happened and insight on how rates can be affected.

Additionally, workers compensation costs will be affected. According to the National Council on Compensation Insurance (NCCI), if only 10% of healthcare workers contract COVID-19 and all of the related claims are deemed compensable, costs for workers compensation claims could double or even triple in some states. I could devote an entire Slice on that topic; however, the conclusion is, don’t expect workers compensation rates to go down in the near future. So, as you prepare for this “hard market,” there are proactive steps you can take to protect your business. First and foremost, review your risk scenario and analyze where you can employ improved systems to alleviate the threat of a loss. While some companies can be severely affected by making no changes, those that proactively apply proven risk mitigation processes and procedures will be the ones that reap the benefits. The hard market won’t last forever, but it does teach us that the industry will adapt as a result of the current environment. Insurance is a pooling of risks supported by a large number of policyholders. If your company or personal asset bundle presents a less risky scenario than others, you stand to see better rates over time. That said, the current state of affairs has an effect on all policyholders, so even the better risks will likely see increases in the near future until the hard market finds a reason to soften. Sources:

|

Employee Benefits |

RIsk Management |

A Member of PCF Insurance Services

CA License #0L78680

|

Hipskind Seyfarth

|

Site powered by RyTech, LLC

RSS Feed

RSS Feed