|

The end of 2019 is right around the corner, and so much has happened since the beginning of the year!

The most notable change of 2019 happened in January when Hipskind Seyfarth Risk Solutions joined forces with PCF Insurance Services. Unlike many traditional large brokerage companies in our industry, PCF Insurance Services has assembled a quality group of independent brokerages. They support a platform where each company continues to operate with their existing best practices. This partnership provides expanded access to a much broader portfolio of solutions for our customers. In fact, PCF Insurance Services is a top 100 broker in the U.S., and my partner Mike and I are principals in the organization. This exciting change accompanies new strategic goals for our organization, as we now have more horsepower in our back office to assist our customers. That said, we will continue to operate with the same values and represent our customers in the same hospitable manner that we have in the past. In addition to joining the PCF Insurance Services family, Hipskind Seyfarth Risk Solutions added the Leonard H. Franks & Associates agency to our greater Chicago portfolio. Located in Northfield, IL, the agency specializes in affluent personal lines coverage (homes with a value above $750,000) and small to mid-sized commercial coverage. Started in 1948, the L.H. Franks agency has an excellent reputation for quality and service. We are excited to join forces and strengthen our capabilities. We, unfortunately, witnessed another year of global catastrophic losses in 2019. After 2018, a year in which the U.S. experienced 108 catastrophic events responsible for 355 fatalities and an estimated $52.3 Billion in insured losses (an estimated $81.9 Billion in overall losses), you’d think nature would have provided a much-needed break in the action! While 2019 isn’t over yet, it too was packed with some staggering and unfortunate catastrophes, with significant insured losses to date. As a result of this commotion, we are seeing some tightening in markets that are prone to storms, wildfires and other unavoidable events that lead to widespread damage and losses. From a personal lines point of view, the most significant peril is water. Whether it’s from floodwaters, backed up sewers and drains, frozen pipes or mechanical failures, water always seems to “win” in the loss category. As we’ve discussed in past Slice articles, there are several precautions you can and should take to ensure your losses are minimized or avoided entirely if you run into a water problem. Remember, we’re always here to assist you with insight! The end of a year is always a good time to reflect back on the good and the bad. It also presents an opportune time to analyze how prepared you are for the year ahead. Analyzing risk is a dynamic process. Every year presents new challenges for how risk is measured, mitigated and covered. Cyber coverage is a great example. Just a decade ago, cyber liability coverage was a small concern and not very prevalent. Today, even personal lines carriers are including options for cyber coverage; and if a business uses a computer, they likely have a cyber liability policy in place. Before raising a glass to the New Year (and new decade), take some time to review and analyze your risk and coverage options. Give us a call—we will be happy to assist. After all, we are more capable to assist you today than ever before. We wish you a safe, healthy and joyous holiday season!

0 Comments

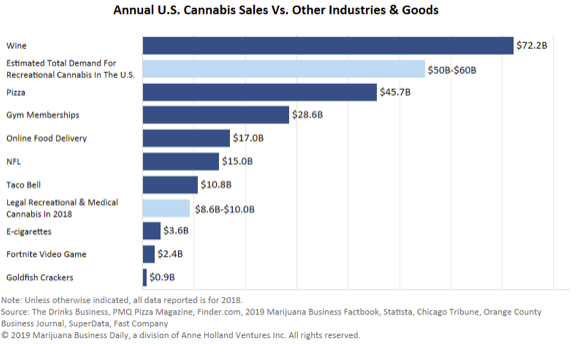

As of January 1, 2020, you will notice a familiar smell increasing in its intensity around Illinois. And no, it’s not going to be from an abundance of skunk roadkill either. It will be as a result of the new legislation passed in the Illinois general assembly allowing the recreational use of marijuana. While the use of marijuana for medicinal purpose has been legal in Illinois and 32 other states, recreational use is not as prevalent. In fact, Illinois is the first state to legalize recreational use of the weed through legislation and not through a vote by the citizens of the state. There are 10 other states that currently allow recreational use. Further complicating the issue is that the use of marijuana remains illegal at the Federal level as it is considered a schedule I illegal substance under the Controlled Substances Act (CSA). That fact creates many complications for those involved in the business, including how they process and store revenue received from sales. (Due to the fact that marijuana is illegal at the federal level, federally insured financial institutions are not allowed to accept deposits for marijuana sales. – See FinCEN Letter of 2/14/2014) As a result, for those of you that are old enough to remember the TV show, you might start to imagine a “Get Smart” kind of security system protecting the product and cash related to the business. There are two products that are relevant to Marijuana. First is THC (Tetrahydrocannabinol), which is the compound that creates the “High” and is the potent portion of the drug. It is also the reason that marijuana is classified as a schedule I substance under the CSA. The other is CBD (Cannabidiol). CBD can be derived either from the marijuana plant itself or it can be derived from Hemp. While not psychoactive like THC, CBD derived from Marijuana is considered a controlled substance. On the contrary, CBD derived from Hemp contains not more than 0.3% THC and, as a result of the Agriculture Improvement Act of 2018 (AIA), the federal government has legalized industrial hemp. (The AIA does not preempt state and tribal laws that regulate hemp in a more restrictive manner.) As you are probably already aware, there are certainly known medicinal advantages to THC and CBD, especially as a replacement for other forms of drug therapy for pain such as the highly addictive Opioids. That’s not to say that THC is not an addictive drug either. It remains to be seen just how much of an effect it will have on society as its use becomes more prevalent. Certainly, states like Colorado have seen increases in fatal automobile accidents since marijuana has become legal for recreational use. Unlike alcohol, currently law enforcement does not have a reliable impairment test for marijuana to identify impaired drivers. It also creates complications for those people in high-risk jobs, as THC can be detected in the bloodstream for weeks after the “High” has expired. It then becomes a judgment call as to when the drug was last consumed, creating challenges for HR professionals tasked with administering zero-tolerance drug policies. Notwithstanding the aforementioned issues, the industry is “growing like a weed.” Projections are that by 2020, the industry will realize over $20 billion in annual sales, from approximately $9 billion in 2017. As other states and perhaps the federal government move to end prohibition, growth will certainly continue at an exponential pace. We have the expertise to assist with the insurable risk portion of the business. It can be complex and there are many moving parts, but now that it’s a legitimate business in Illinois and other states, if you enter this industry we can help you protect your interest.

I’ve just returned from our annual trip to Washington DC with my partner, Mike. As legislative co-chairs for the local chapter of the National Association of Health Underwriters (NAHU), we meet with other members of the industry and coordinate talking points to share with our respective congressional leaders as part of a NAHU event called Capitol Conference. This year, nearly 1000 professionals attended, as there are many issues that deserve our lawmakers’ attention. I do not expect you to fully engage with many of our talking points-unless of course, you are a professional in the health care arena. Despite the granularity of the information, there are a few topics that you can/should discuss with peers at dinner parties, book clubs or other social engagements. As stated by the chief legislative aid of one of our democratic representatives from the Chicago area, “Sometimes the more radical legislators work too hard for an outcome for which they don’t understand the negative repercussions that we all end up having to live with.” This comment was articulated as the discussion of single payer healthcare or “Medicare for all” was circulating around DC. I will share a general list of talking points with you later; however, one issue worth addressing in greater detail is the Cadillac Tax. The following infographic gives a summary of the initial intent of the new tax and the ensuing unintended consequences if it is implemented (it’s currently delayed and congress is contemplating a permanent repeal). The Cadillac tax was just one of over 17 taxes initially proposed by the Affordable Care Act (ACA). Following is a summary of the general talking points that we discussed. While there is much detail behind each bullet point, you can get an idea of the scope of work that needs to get done to keep us on the road to improvement.

Market Stabilizers to Reduce Cost and Improve Individual and Employer Market Risk Pools

Return on investment (ROI) has become a popular concept for companies, charitable organizations, households and even government agencies (humor emphasized). In simple terms, it’s a measure of the benefits delivered above the costs expended for a product or service.

There are many circumstances when it’s easy to measure ROI, such as when you invest in a security or put money in the bank. However, it’s not always so cut and dry. Take health care costs, for instance. You’ve heard me talk about limited transparency in the health care space. It’s difficult for the average consumer to investigate the actual out of pocket (OOP) costs associated with the most basic medical procedures. An MRI image can vary in cost by thousands of dollars, depending on where the MRI is administered. The same goes for an operation. In fact, many people don’t know that surgeons are often accredited to perform procedures in multiple hospitals. The actual procedure cost is a constant, while the facility charges and other necessary services can vary significantly. By making the correct facility choice, you could save thousands. Take note of the following real-life example: A patient calls to pre-certify a total knee arthroplasty surgery. Without any professional assistance, the patient wouldn’t know the following facts (actual facility names have been altered): 1 Facility Total Cost **** Memorial Hospital $28,400 **** Methodist Hospital $70,108.12 **** University Hospital $23,300 While all three hospitals have acceptable quality ratings and are geographically compatible, the least expensive option has the highest quality rating (believe it or not). By choosing the least expensive option, the patient saved 67 percent over what he/she could have paid. Unfortunately, without assistance from a professional who can research the relative costs, it’s difficult for the average consumer to reach an educated decision. That will change, as transparency in the medical cost arena is evolving. Someday – probably sooner than we think – we’ll be able to shop for health care like we do for any other goods. In the interim, here are some simple things you can do to positively influence your ROI:

1 Actual data received in 2016 from Paradigm Health 2 US Dept. of Health and Human Services 3 Expenses vary by plan. Time flies. That’s been a common saying throughout the ages. And indeed, the older you get, the faster the time seems to pass. I remember when I used to think of people my age as being old. Not “Over the hill” old, but old, nonetheless. And although we are living longer and, in many cases, healthier lives, we still will face the inevitable reality of the kind of “Old” that requires us to analyze just how we will manage our affairs as the burdens of a long life begin to take a toll on our bodies.

The truth is, once you live past a certain age, call it 55-60, odds are that your life expectancy, barring any catastrophes or abundant bad habits, will be relatively long. Facts state that our body, like any living thing, has a life expectancy. Current estimates range from ± 90-95 years of age. The average is currently 80, although that will likely increase as long as we continue to advance in our ability to keep the human body alive. In the 1940s, antibiotics were widely introduced as a medical treatment for disease control. During the 1950s, there was much advancement with medical technology. In fact, the first hospice in the United States was not introduced until 1978. Now there are hundreds throughout the country and world. Not that long ago people did not live as long as they are living today. They worked, retired and had a few years until they expired. While it’s a good thing that we are not experiencing that same cycle today, our current reality does come with some complications. Those complications are related around care. Indeed, one can live a fulfilled life without having all human faculties available. That said our activities of daily living (ADL) are susceptible to breakdown as we age. Activities of daily living include; bathing, continence, dressing, eating, toileting, transferring and cognition. And, while assistance might be available from time to time, it’s not cheap to provide constant care. In fact, most people who require care without a plan to pay for it end up exhausting most of their assets in order to fund required services. 1 Those without alternative resources typically rely on family members and friends, who have to skip work and sacrifice resources to deliver care. That simply drives the loss factor into the next generation’s ability to create wealth. It’s estimated that 7 out of 10 people 65 years old or older will require an average of at least 1 to 3 years of long-term care. 2 So, what’s the solution? It starts with a plan. If you are independently wealthy and can afford to let $7,000-$10,000 a month go towards care 3 then you might be OK. Conversely, that $7,000-$10,000 could have gone to your heirs, your favorite charity, or remained in your estate if you didn’t have to use it for care. Notwithstanding your wealth, you could also invest in a long-term care policy. Similar to a life insurance policy, once you have satisfied the requirements for benefits (Needing assistance with at least two ADL or having lost cognitive ability) the long-term care insurance (LTCI) begins to reimburse you for qualified expenses. You maintain your wealth, you keep your investments and you have a stream of money to assist you with the expenses relating to your care. 4 The problem with LTCI is that many people do not have it. Similar to life insurance, the older you get, the more expensive the premiums. In fact, only about 4.8 million people have LTCI coverage today. The average age to purchase LTCI is 57, although many invest at a younger age. 5 The largest percentage of applicants (55%) falls between the ages of 55 and 64. The problem is that not only are premiums higher as you age, but health conditions that might interfere with your ability to gain coverage are more likely at an older age. The following statistics illustrate this point: Age Range Decline % Due to Health Conditions 60-69 years old 27% of applicants 70-79 years old 45% of applicants Less Than 50 years old 14% of applicants Therefore, if you plan to have coverage, it’s best to plan relatively early, as premiums are lower and the likelihood of gaining approval for coverage is greater. 6 The moral of the story is that you are not getting any younger. The older you get, the faster the time goes. It’s never too late to plan for your needs as you age. And, LTCI does not only serve for old age related ADL deficiencies. It also delivers benefits when a younger person suffers a disabling condition requiring care. Benefits are typically cumulative and some policies have riders allowing for spouses to share benefits. That’s especially helpful when one spouse is cared for by a healthy partner for a period of time prior to the other spouse requiring care at a later time. Shared Care riders are becoming much more common in today’s LTCI policies. Many life insurance products also have accelerated benefit riders to assist with LTCI needs as well. Now is the time for you to plan for the future. Having a LTCI policy will set you up for the inevitable expense of caring for you later in life. That way, you can enjoy your relatives and friends, as opposed to enslaving them for your care. Although they love you and would likely commit to assisting you, the sacrifices they make to assist will most definitely have a significant impact on their time, finances and quality of life. Having a long-term care policy will provide the resources you need to allow them to enjoy you during your time of need. And remember, Don’t Blink! It goes by in a flash. 1 Medicaid requires one to exhaust personal assets significantly, prior to providing benefits. 2 2015 Medicare and You NationalMedicarehandbook, Centers for Medicare & Medicaid Services, Sept. 2014. 3 Estimate. Amounts differ based on geography, level of care necessary and source of care. 4 LTCI policies require that a licensed physician authorizes that LTCI requirements have been met. Care must typically be administered by a licensed professional and benefits begin to be paid after a contracted elimination period as defined in the policy. Policy terms differ and careful analysis is recommended prior to executing an agreement for coverage. 5 LIMRA 6 Similar to Life Insurance, LTCI premiums are rated on factors including age and health conditions after medical underwriting. You have undoubtedly heard of the 80/20 rule, where 80 percent of the results are typically produced by the top 20 percent of your people. Previously, this rule seemed to hold true in many areas, including medical claims. Eighty percent of your medical claims costs were caused by 20 percent of your employees.

However, based on the following facts 1, the old 80/20 rule is no longer the current standard for medical claims.

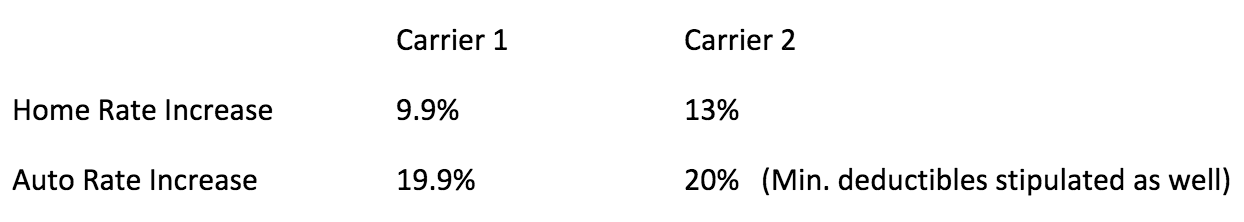

So, how do we combat these facts with real solutions? That’s the loaded question with a multifaceted answer. Living a healthier lifestyle is the most obvious conclusion. However, alternative forms of treatment and therapies are also considerations. There’s no doubt that the debate on how to solve the chronic disease conundrum will continue. One thing is for sure, it will take more than the medical community to solve the dilemma. While I can supply another bullet point list of recommendations, it’s likely you already know what you can do, if in your control. A good start is to make sure you have an annual physical appointment (most plans include it without a co-pay). Early detection is a key for sustained health and lower costs of treatment. The longer you go with a latent issue, the more harm it will cause down the road; both physically and economically. Make that a first step in your personal plan. You might save all of us some money! 1 Source: Benefits PRO magazine August 2018 article “Data Analytics” authored by Richard Kersh and Chris Caramanico (Orthus Health) 2 Source: Mercer FOCUS database for active employees and their dependents. ($8.5Billion in aggregate average annual costs and 1.6 Million members. Claims incurred between July 2016 and June 2017.) As we encounter the tumultuous spring weather, you might be wondering, “When it will end?” Not spring, of course, but the thunderstorms, wind and rain that are part of the season. Your homeowners insurance and auto insurance rates may also see some stormy weather as policies renew this year. Why? First and foremost, insurance is a transfer of risk. Large pools of individuals contribute money to a fund out of which losses can be paid. Conceptually – and in practice – the larger the group, the better off you are financially. However, sometimes, even despite the “law of large numbers,” the pool suffers. Following are some facts to assist you in understanding what’s been going on in the world of paying for losses. During 2017, the insurance industry faced more than 41 catastrophic losses and paid in excess of $200 billion. For relativity, that’s more than six times the amount paid for catastrophic losses in an average year. During the first quarter of 2017, severe thunderstorms and convective weather were responsible for $5.7 billion in insured losses in the U.S. alone. Not all companies are affected equally with respect to losses. It’s a function of how diversified their book of business is, with respect to geography and demography. An example of what’s coming from two carriers for Illinois rates in 2018 follows: The aforementioned example does not and likely will not pertain to everyone and all companies; however, when you review your renewal, at least you will have some knowledge of why your rates might be rising.

Many of the homeowner’s claims are related to water. Even in non-coastal areas, it seems water damage has a significant edge over other types of losses. Whether its ice damming in the winter months or a basement flood during spring storms, water always wins! While not all catastrophic losses involve water, especially as we witness the fires and devastation from the Hawaiian volcanic eruption, water losses deserve attention. Think about some of the following tips for mitigating the potential for future losses. Remember, a backup generator system for your home can save you when power outages occur. Also, keep in mind that your sump pump doesn’t come with a life expectancy. In other words, some can run for many years and some can fail within several years, even if your power is on. Therefore, have the sump checked periodically and replace pumps that have been in service for many years. And not all water losses are caused in and around the sump pit. Many are related to frozen pipes and/or a leak in a water supply pipe. Water shut off systems can be very effective tools in reducing the damage when there is a leak in the water line. Clean gutters and keep your roof area free from hanging branches and other obstacles that can cause harm during a storm. And remember, fires can start during a rain storm. In fact, during 2016, more than $825 million in lightning claims were paid to more than 100,000 policyholders. And, speaking of lightning, stay indoors and avoid being exposed to lightning. 2016 also delivered 38 deaths from lightning, up 46 percent compared to 2015. 1 When it comes to autos, you have read plenty in past Slice articles. Above all, put down the phone and be alert when driving. Distracted driving has contributed to abundant losses and even traffic deaths. Even more troublesome is the propensity for another driver to be uninsured. Although laws in most states require a minimum amount of liability insurance, approximately 13 percent of all drivers are uninsured, according to the Insurance Research Council. 2 Accidents involving uninsured motorists cost your insurance company more money when settling claims. As we continue to deal with every day and catastrophic losses, there are ways to manage your policies and gain some efficiency. The carriers we work with also assist in consulting on risk mitigation strategies to assist you in avoiding unnecessary losses and claims. We are here to help you identify ways to efficiently manage your risk so you can sleep during the storm. Call us for a review. 1 National Weather Service 2 Florida tops the list at 26.7% in 2015 while IL stands at 13.7% You’ve probably heard warnings from our government regarding Russia’s willingness to disrupt our cyber society; but we’re still not certain just how much havoc the Soviet state has created or how much potential damage they can cause. Even without Russian interference, the size of the global cyber insurance liability market was $3.4 billion in 2016 and is projected to grow to $16.9 billion by 2023 (CAGR of 20%). 1

If you run a small business, here are seven primary cyber exposures you should protect:

Now, let’s jump to the nonobvious risk: your dog. Believe it or not, nearly 90 million dogs live in the USA, and in 2011 alone, there were approximately 4.5 million reported dog bites. Of those, 800,000 were serious enough to warrant medical attention. You might think all of those angry dogs live elsewhere; however, Illinois sits in second place for the most claims with four other Midwestern states earning status as one of the top 10. One major insurance company paid out $132 million in dog related claims in 2017 alone (as a result of 3600 dog related injury claims). 2 While dog ownership can be rewarding, knowing your homeowners insurance coverage is certainly recommended. Even the nicest dogs can become agitated and unpredictable when tormented or threatened. Umbrella liability coverage becomes handy when a claim occurs, especially when the limits of your Homeowners policy won’t cover the damage. Take time to review your coverage needs, so the obvious and nonobvious issues are addressed. Call us today! 1 P&S Research Report, National Underwriting Magazine. 2 Property & Casualty 360 Recently, my partner Mike and I returned from Washington, D.C., after our annual trek to the National Association of Health Underwriters (NAHU) Capitol Conference. Mike and I are the legislative co-chairs for the local chapter of NAHU. Our trip involves communicating our clients’ issues regarding the health care market and identifying positive ways of improving the current state of affairs. As you might imagine, similar to the past six years, there were plenty of issues to discuss.

The three major areas of discussion included:

And while we feel there is a window of hope for improvement, there are still problems that need to be resolved. For example, as a “Treasury Watchdog” reported in the Washington Times, the IRS overpaid nearly $3.5 billion in ACA tax credits in 2017, of which it can no longer recoup due to constraints built into the act. Makes you wonder who’s really watching the henhouse (or, who’s drafting the legislation)! Despite the ongoing turmoil surrounding the ACA and healthcare in general, we will continue to listen to our clients, proactively discuss solutions and hope for wholesome free market solutions as time moves on. In the interim, we’ll be here to provide continued guidance in this ever confusing and complicated world of options. 1 Overpayment resulted from outflows of $24 Billion in subsidies with $5.8 Billion in overages of which only $2.3 Billion was clawed back because of limits on the $ amounts that can be recovered. When asked, “What’s your most important financial asset?” how would you answer? Some of the more common responses are, “my house, my car, my retirement account” or any combination of physical “things” we identify with that have significant (relatively speaking) value.

At least initially, very few people would answer the question with these words – “My cash flow.” As abstract as it might appear, cash flow – for most people – is the most important financial asset we have. This begs us to explore how cash flow generates potential for risk. Generally, there are four circumstances that can negatively affect your cash flow:

A disability insurance policy is designed to protect your cash flow. For those earning a decent salary/income, or for a person who possesses a unique skillset without which he would see a significant decline in income (e.g. surgeon, attorney, etc.), a disability policy is paramount. When analyzing cash flow, especially when you are younger, a life changing disability can not only change your quality of life physically, it can put you on a financial vector far off course from your original plans and dreams. Many employers include a standard disability income policy for their employees (if not, they should) – that is one step in the right direction. However, most employer-sponsored policies limit benefits to a maximum of 60 percent of the current earnings up to a maximum dollar amount. And, unless the premiums are paid with after-tax dollars by the employee, those benefits are taxed when received. Therefore, the actual cash received will be much lower than 60 percent of your current earnings. To soften the blow, there are supplemental disability products available. Typically secured by higher paid professionals, a supplemental policy can help bridge the gap between what the standard policy payout delivers and getting you closer to what you currently earn. Most disability products will fall short of 100 percent of your salary, as there needs to be the incentive to become well again and get back to work. Most high-quality disability carriers possess a professional staff to assist you in coordinating care for back-to-work purposes. Just for reference, following is a list of some of the top causes for a disability:

|

Employee Benefits |

RIsk Management |

A Member of PCF Insurance Services

CA License #0L78680

|

Hipskind Seyfarth

|

Site powered by RyTech, LLC

RSS Feed

RSS Feed