|

With the holidays upon us, I thought I’d borrow some wisdom from the “Who’s” down in Whoville and quote Dr. Seuss’s “How the Grinch Stole Christmas.” Here are some tips to keep your holiday from turning into a “Grinch-mas!” 1. “Give me that! Don't you know you're not suppose to take things that don't belong to you?”Secure your homes this season by locking your doors and windows, turning on your security systems and keeping your belongings out of site. Although the economy is improving, there are still some people desperate to see what you’re hiding under the tree this year. 2. “Burn baby… BURN!!!”

Be sure your electrical connections and cords are in order. If you’re lighting a real tree, ensure that it is clear of hazards, make sure there’s enough water in the basin below the tree to keep it hydrated and consider LED bulbs to reduce heat. 3. “Don’t worry about that now Max, we’ll get that later. Of course when I say we, I mean you!” Like the Grinch, take advantage of helpers. If you have someone willing to assist you with carrying heavy loads, cooking or cleaning, allow them to do so. Many minor, yet hindering injuries happen as a result of people trying to do too much on their own. 4. “Dinner with me? I can’t cancel that again!” This time of year can be hectic with work, holiday parties and other commitments. Remember to plan your time accordingly so you aren’t overbooked or overwhelmed and can set aside time to relax. 5. “Am I just eating because I’m bored?” Stay disciplined with your routine and avoid eating that third piece of pie. You’ll appreciate it after the New Year arrives when you still feel comfortable in your clothes! 6. “One man’s toxic sludge is another man’s potpourri!” The pre-holiday season is a great time to give back! Go into your closets and storage areas and get rid of some things you have been hoarding for a while. Many charities will help the less fortunate by reusing some of your older belongings. As the Grinch realized, it's important to take time to appreciate what the holidays are all about. Reflect on the year past and look forward to the year ahead. Enjoy the time with family and friends and have a safe and happy holiday season! “What if Christmas, he thought, doesn't come from a store. What if Christmas... perhaps… means a little bit more!”

0 Comments

Lately, insurance companies have been taking the brunt of the negative press regarding escalating health care costs. While some of the blame certainly relates to the way that insurance companies negotiate rates and corresponding discounts with hospitals and doctors, there are many other factors contributing to the problem. Following is a list of only some of the most significant issues contributing to the cost conundrum. 1

More than $6 billion was spent between 2010 and 2015 to update provider’s systems to comply with ICD-10 coding. To date, there has been very little to show for this expensive reboot to the medical records database. While the intentions are good and the electronic records can be very beneficial, the investment is enormous and there are many inoperability issues hampering progress. Believe it or not, mistakes also contribute to the problem. As many as 400,000 people die each year as a result of preventable medical errors. It’s estimated that these errors cost the Americans approximately $1 trillion each year. Tragically, it affects the cost of providing health care to everyone. Many hospitals and providers are proactively working toward a team approach whereby physicians, nurses and other practitioners are encouraged to speak up and be on alert for human errors. Despite that effort, it will take many years to change the bureaucratic system within many of our hospitals to reduce that cost to $0. The PPACA (Patient Protection and Affordable Care Act) has been anything but affordable for society. Many burdens on employers have discouraged small employers from participating in providing health care as a benefit. For individuals and small employers, narrow rating bands, limits on composite rating and expanded levels of minimum coverage have resulted in higher costs. Larger employers (>50 full-time equivalent employees) have become overwhelmed with the reporting requirements and affiliated government mandates. The law has also affected state governments as expansion of Medicaid will soon start to create increased costs to states that are not budgeted to handle the increased burden. So before you get too angry with your insurance company, keep in mind they are only responsible for assisting you in paying for your health care. If you don’t question and challenge the issues surrounding the costs associated with providing the healthcare, the vicious circle of higher costs will continue to haunt! 1 Source: Healthcare Cost Drivers White Paper June 2015 - National Association of Health Underwriters 2 Source: Robert Wood Johnson Foundation. 3 Source: National Center for Health Statistics. 4 As concluded by a Congressional Budget Office Study There is no education like experience. Unfortunately, many people in the Texas coastal region and neighboring states will have the unfortunate episode of learning through experience as a result of the wind and subsequent flood damage created by hurricane Harvey. Just for a relativity test, Hurricane Katrina left a $15 billion price tag in Louisiana and Mississippi alone, relating solely to the claims paid by the National Flood Insurance Program (NFIP), which is managed by the US Federal Emergency Management Agency (FEMA). Harvey’s destruction is projected to be far more severe.

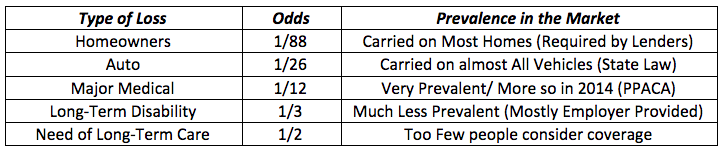

I’ve mentioned in the past, “Water always wins.” That unfortunate fact seems to surface at the most inopportune times for those dealing with flood losses. It’s enough to lose heirlooms and precious belongings. It’s even worse to lose in the claims process when you realize that you do not have coverage for a flood event. Standard homeowners policies, while typically including some coverage for backup of sump pumps and sewers (and not all policies are created equal), do not cover losses from floods (water entering the home from rivers, streams streets, etc.). Additionally, those policies typically do not cover named storm wind damage without an endorsement for hurricane/wind coverage. This type of coverage is more common in coastal regions of the country and is subject to much higher deductibles than the standard policy. There are flood insurance policies that can be purchased through private insurance companies or directly through the NFIP. Dwelling coverage for the building will cover up to $250,000 and personal property is covered to $100,000. For those that want to increase coverage, there are excess flood insurance plans available through private insurance companies to supplement the primary coverage. Depending upon where you live, flood insurance might be mandatory, based on FEMA’s mapping of the various flood zones throughout the U.S. Floods do occur in non-coastal areas. According to FEMA, the average flood claim from 2008-2012 was $42,000. The average flood insurance policy cost $650/yr. in 2012. There are various ranges for the subsequent years; however, in 2017, prior to Harvey, the average through the first five months was $24,698. The average for 2017 is obviously going to go up significantly as a result of the disaster in Houston and surrounding cities. A big question remains, how many people actually have coverage for the loss? So, perhaps now is the time to analyze your risk of a flood. Be careful not to analyze your risk when a storm is approaching, as most companies put out a moratorium on writing new coverage when there is a risk of loss on the horizon. The same rule applies to wind coverage. Don’t wait until hurricane season to try to secure wind protection. And remember, water always wins! Ever gambled? Believe it or not, you gamble every day. Most of our daily wagers are calculated actions with a downside risk, as a result of our propensity to avoid trouble. Unfortunately, many disturbances in life are unavoidable. Illness, injuries, accidents, storms and even aging are all outside of our control. Look at the following statistics referring to the odds that you’ll need to be covered for a loss: After reviewing the odds, it’s surprising that we typically don’t think about covering the issues that deliver the highest odds of potential loss. Or, perhaps we do think about it but say, “I’ll worry about that later.” Consequently, waiting oftentimes comes with a cost.

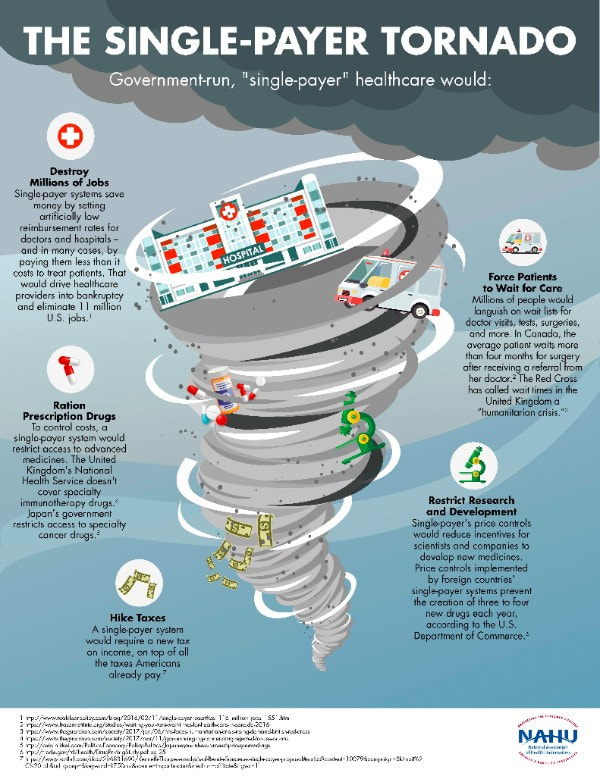

While we are typically required to carry insurance for our largest assets, and agree with the logic to do so, we seldom think about insuring our future productivity, especially if our ability to produce was taken away. It’s like insuring the “Golden Eggs” and neglecting to insure the “Goose” that lays them! Additionally, we know that someday we’ll be potentially incapable of caring for ourselves without assistance. It’s okay if you’re independently wealthy and can afford to pay for care in your old age; although, after years of wealth accumulation, wouldn’t it be nice to preserve that wealth for more productive purposes on behalf of your legacy? Without wealth to see you through the later years, who will you count on for assistance? When gambling, sooner or later the casino wins. The longer you gamble, the higher the odds are that the house will take your money. The game of life works in a similar manner for those who wait to prepare for the future. By now, you’re likely not only aware, but sick of the conversations and controversies surrounding our health care environment. For many, trying to figure out the system and afford decent coverage has been a bit like living through a tumultuous thunderstorm. For those with comprehensive benefits and a plan sponsored by an employer with deep pockets, you may not feel much pain from recent rate increases and plan changes. However, that is the exception, as most working individuals have felt negative impacts from the current state of affairs under the ACA. Many people, including some members of congress, have sited that a single payer system is best for everyone … Perhaps a closer look at the ensuing weather report might convince them otherwise: No matter where you stand on the issue, one thing is for sure: It won’t be easy to appease everyone as we sift through the debris left over by the current health care climate and transition to whatever we end up with; hopefully, NOT a tornado!

Prescription drugs (Rx) have become a necessity for most Americans, and many people who are employed and covered by a group health plan have a prescription drug card (Rx Card) to assist with the high cost of meds. The Rx Card allows for a co-pay level that is tiered based upon the type of drug prescribed. Lower cost generic drugs typically have low co-pays, while more complex brand name drugs have a higher co-pay amount. Very expensive meds, including injectable formulations, fall into the highest tier and frequently come with co-pay amounts that compute to a % of the drug cost. Those drugs are frequently very complex and expensive.

Today, more people are covered by a High Deductible Health Plan (HDHP) coupled with a Health Savings Account (HSA), whereby a Rx Card is not customary. While there are tax benefits connected to the HSA, one of the sacrifices is that you share more in the initial cost of treatment until you have satisfied the Out of Pocket (OOP) maximum amount. In most HSA plans, this includes prescription drug costs. Recently, prescription drugs have become a targeted item by consumers. Many insurance companies have dropped certain popular and expensive brand name drugs from their formulary. The National Blue Cross and Blue Shield Association completed a 7 year analysis of Rx utilization, price changes and costs. That study concluded that, since 2010, spending on prescription drugs has increased 73%, or roughly 10% per year. This is despite the rise in generic Rx use during that same time period. The increase is predominantly due to a smaller fraction of emerging drugs and larger year-over-year price increases that are more than offsetting the growth in lower cost generic Rx use. It’s easy to blame the pharmaceutical companies for high prices; however, one must dig deeper to understand the complexities involved and dollars invested to bring a Rx solution to market. Based on the FDA and affiliated governmental requirements surrounding testing and trials prior to approving a drug, don’t hold your breath for a quick decline in the costs of bringing the solutions to market. There are some practical tips for you to follow in order to better manage your Rx costs.

I was recently commuting into the city enjoying a rare occasion; traffic moving smoothly on the Eisenhower Expressway between Kostner and the Jane Byrne Interchange. Suddenly, I had to press on the brake, not knowing what was ahead, when the car in front of me instantly halted. After stopping and going through the typical gyrations of stop-and-go traffic following my frantic braking episode, it appeared that someone about eight cars ahead of us was attempting to text and drive and allowed more than a quarter of a mile between his car and the car in front of him to remain clear of traffic. I came to this realization as I passed his car and witnessed him trying to appropriately navigate traffic while texting. It was so obvious he was the culprit that I wondered, “Where are the State Police when you need them?” It is illegal to text and drive, by the way!

Currently, there is a Bill in the Illinois Senate (SB 2036) proposing to increase speed limits from 70 to 75 mph on rural interstate highways and from 55 mph to 60 mph on two lane non-urban highways. The Bill is sponsored by Jim Oberweis and, for those who travel often on long stretches of rural highways, it certainly makes sense. However, the insurance industry views things a bit differently and will likely fight the Bill for the sake of saving lives. It’s no secret that the faster you go the worse the results of an accident will be if/when it occurs. To prevent accidents, injuries and claims, the insurance industry certainly can’t be found to be illogical. That said, when you analyze most circumstances of danger on the highways, distracted driving is more often the culprit than speed. This fact is evidenced on Interstate 294, where the average vehicle travels at 75 mph on any given day. Another thing to note, many of those cars are Uber/Lyft drivers looking at their mobile devices trying to locate their next fare. The Illinois State Police cite that there are not enough officers to appropriately patrol the texting and driving issue. Therefore, the insurance industry argues that with distracted driving taking place, increasing speeds is not an ideal solution. Although it’s a fact that insurance companies and law enforcement agencies review cell phone data usage at the time of an accident, it will always be too late as the accident already occurred. [Note to all with youthful drivers; remind them of this fact and remain strict about mobile device usage while driving.] So, don’t get too excited if you thought that you might be able to finally travel legally at the speeds that you may already be driving. Although some states west of Illinois are already travelling legally at 75 mph, it doesn’t appear that Illinois is likely to join the club in the interest of safety. Notwithstanding the fact that the speed itself is not routinely the problem, the speed certainly does cause the distracted driving situation to worsen. Our ability to stay connected at every moment of the day has probably thrown a major cog into that wheel. With a new Commander in Chief and a retooled Congress, you are probably wondering what the fate of the ACA (Affordable Care Act, AKA: Obamacare) will be. Contrary to many beliefs, the ACA is still alive. Although President Trump issued an executive order (EO) to soften the effects of any mandates that the act prescribes, until it is repealed, replaced and or altered, the rules still apply. There is quite a bit going on behind the scenes in congress, as you’ve likely read, and the odds of change to the status quo are not only high, but certain.

Realistically, the President’s party does not control enough seats in the Senate to completely repeal the ACA. They do have the voting power in the House of Representatives to change much of the act through a process called Budget Reconciliation. That is where the House can enforce changes to the law that have a direct effect on the congressional budget. Mandates that do not affect the budget, such as Guaranteed Issue (Which guarantees coverage, notwithstanding pre-existing conditions) and keeping a child on your policy until age 26, are not issues that can be changed through the budget reconciliation process. Budget reconciliation simply requires a majority vote. In order for a full repeal of the act, a supermajority (60 votes) in the Senate is required, which is not only unlikely, but pretty much impossible under the current congressional climate. (The Republicans only control 52 seats in the Senate.) So, in the short-term, continue to follow the existing rules. It appears that the IRS is still enforcing the present regulations and penalties. As time passes in the months to come, expect there to be legislated changes that will affect the future of how we acquire and utilize the healthcare system. One of the major challenges to President Trump’s stated intentions to improve the healthcare climate is that healthcare costs and the fees charged by providers are not declining. Therefore, we look forward to seeing just how the government will intervene to actually lower the costs. Stay tuned! As I write this slice, temperatures outside are below zero and the Holidays are fast approaching. It is amazing how time has flown and that 2016 is almost at its end. The time of year to give thanks, share time with friends, family and loved ones has once again arrived!

2016 has brought great change and uncertainty to many. The recent election has some hopeful and others dealing with despair. Notwithstanding where you stand, change has no constituency and we certainly are going to deal with change in the coming years. While we all deal with the hustle and bustle of the season and work diligently to get things done, perhaps we should all take a moment and enjoy moments that we seldom make time for to assist us with our mental health. Recently, I did just that, with two of my favorite 2 1/2 year old friends. After a great spaghetti dinner, we all decided to play “Pie Face” to ring in the holidays. I’ve included a link for you to witness a glimpse of the moment for your amusement. Needless to say, hearing the laughter of the children is difficult, as the adult laughter was loud enough to drown out the giggles of my young friends. (Actually, one of my young friends was terrified of the thought that I had been molested by a plastic boom full of whipped cream...Until she witnessed me enjoying the taste!) This, by the way, is the point. Make time to laugh and enjoy your holiday season. Don’t let the real world ruin your ability to enjoy yourself, your friends, your loved ones and perhaps someone you don’t yet know who needs a friend. Take that moment to chill and enjoy the moment, and don’t take yourself too seriously! My warmest wishes for a wonderful Holiday season to all! “I have life insurance through my employer, so I don’t need any more coverage.” That’s a common statement heard across the country, especially from young professionals who believe they’re bulletproof and that tragedies won’t strike in their near or distant futures.

The reality is, just as our parents predicted, time flies. Before you know it, you’re in your 40’s and 50’s, your temporary life insurance policy remains at $50,000 and your lifestyle has grown, requiring six times the income since your younger days. Lately, I’ve conversed with many people who don’t understand the ramifications of not having an appropriate strategy in place regarding life insurance and how various policies can work to assist in planning for the future. One awakening moment, which often comes too late in life, is when we experience the costs associated with caring for our parents as they age as mature adults. Question: Will our kids be around to take care of us? Is it fair to unload that burden on them at a time when they are in the heart of their earning potential and possibly raising a family of their own? And, even if they are willing, why not compensate them? There are many reasons to have life insurance and I won’t dwell on them in this slice. Many are technical in nature, others very simple and straightforward. That being said, I firmly believe everyone should be aware of some important facts concerning life insurance:

Here are situations when you might consider a life insurance product:

|

Employee Benefits |

RIsk Management |

A Member of PCF Insurance Services

CA License #0L78680

|

Hipskind Seyfarth

|

Site powered by RyTech, LLC

RSS Feed

RSS Feed